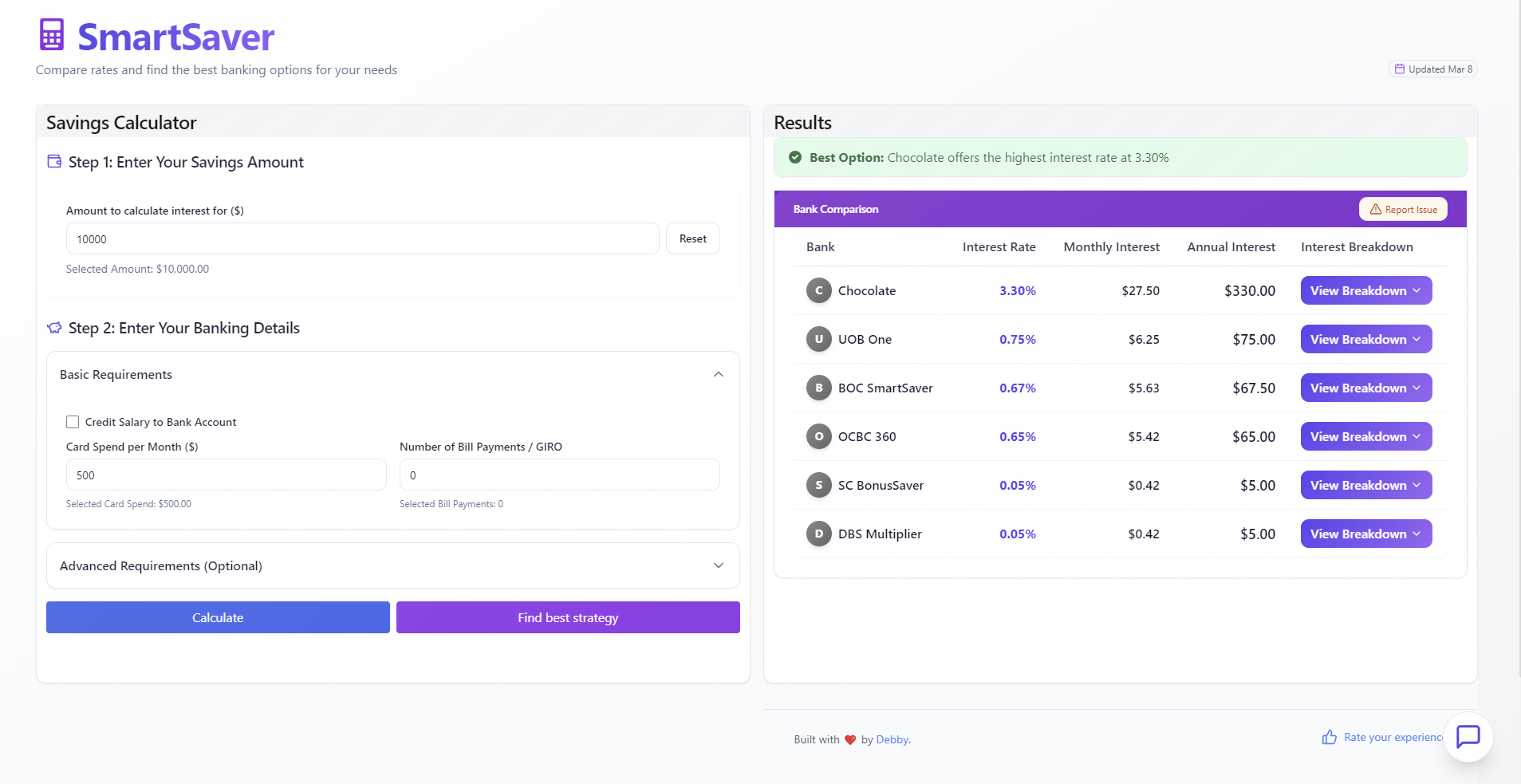

SmartSaver:

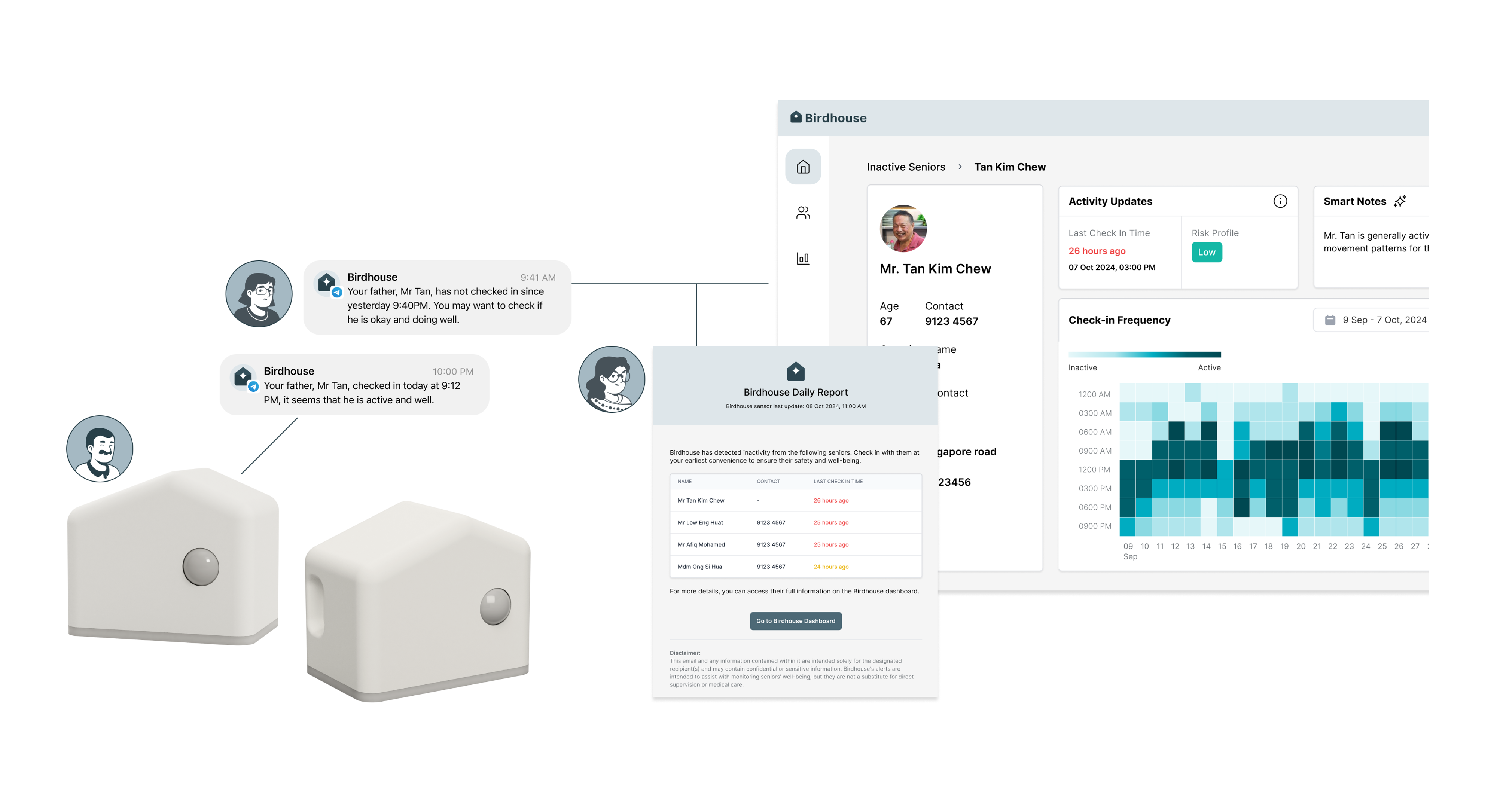

Bank Calculator Tool

Developed an analytics decision platform that transforms complex banking data into actionable financial insights, empowering users to optimize their savings strategy through personalized calculations and an innovative fund distribution algorithm.

Task

Conceptualized, designed, and developed a comprehensive banking calculator tool that enables users to compare interest rates and potential returns from different banks, considering multiple qualification criteria.

-

Role

Product Owner & Developer

-

Date

Mar 2025

-

Tools

React, Tailwind CSS, Supabase, Framer Motion

DISCOVERY

User Research & Insights

My discovery process began with a key insight: despite the abundance of financial comparison websites, none effectively addressed the multi-variable qualification criteria that determine actual interest returns.

Through structured interviews with 15 potential users across different financial profiles, I uncovered three critical user pain points:

- Calculation Complexity: "I can't manually calculate all these conditional tiers across different banks."

- Optimization Challenge: "Should I put all my money in one bank or split it? I have no way to figure this out."

- Information Asymmetry: "Banks make their interest structures deliberately complicated to prevent easy comparison."

Competitive analysis revealed most existing calculators only calculate single bank returns without comparative analysis, ignore multi-variable qualification conditions, present raw numbers without actionable insights, and lack fund distribution optimization capabilities.

PERSONAS

User Personas & Jobs

Through research, I identified four primary user personas:

Beginner Saver

- Looking to save for a BTO flat down payment in the next 2-3 years

- Already has credit cards with several banks but isn't strategically using them to qualify for higher interest rates

- Prefers digital solutions for financial management

"I need to understand how different banking decisions will affect my financial future."

Time-Pressed Tactician

- Manages family finances and wants to optimize returns without spending hours researching

- Has insurance policies and uses GIRO for utility bills and children's school fees

- Time-constrained and needs quick, clear financial information

"I need to quickly determine which bank will give me the best return for my specific situation."

Optimization Seeker

- Has fluctuating monthly income

- Uses multiple banks for business and personal finances

- Interested in optimizing distribution of funds across banks to maximize interest while maintaining liquidity

"I need to optimize my banking setup to maximize interest without spending hours on calculations."

Retiree

- Less comfortable with technology but willing to use intuitive digital tools

- Looking for ways to generate passive income through interest as she transitions to retirement

- Concerned about minimum balance requirements and maintaining access to funds

"I want to keep my money with me but try to maximise my savings. I don't understand all these banking terms and conditions."

STRATEGY

Product Vision & Strategy

Based on user research, I developed a clear product vision: "To empower users to make optimal banking decisions through transparent analysis of complex interest structures."

This vision guided four strategic pillars:

- Comprehensive Analytics Engine: Account for all conditional factors impacting interest rates

- Insight Transformation: Convert complex calculations into clear comparative insights

- Optimization Intelligence: Develop algorithms to determine optimal fund distribution

- Continuous Learning: Collect anonymous usage data to enhance calculations

For feature prioritization, I developed a comprehensive feature set and prioritized it using a value-effort framework, focusing first on high-value, lower-effort features for the MVP, such as the multi-bank interest calculator, side-by-side comparison table, mobile-responsive interface, and basic feedback collection system.

Feature Prioritization Matrix

DESIGN

Analytics-First Design

Unlike typical calculators that simply present data, I took an analytics-first design approach focused on transforming raw calculations into actionable insights. This included creating a logical flow from input variables to insight presentation, developing progressive disclosure hierarchy for complex information, and designing a comparative visualization framework highlighting key differences.

The technical architecture was designed to support complex calculations while maintaining performance and scalability:

- Modular Calculation Engine: Separated core calculation logic from presentation layer

- Data Management: Used Supabase for structured storage of rates and criteria

- Performance Optimization: Implemented calculation memoization to improve response time

- Analytics Implementation: Designed event tracking for feature usage patterns

Data-Driven Input Method Selection

I implemented an A/B test using Mixpanel to determine the optimal input method for the savings amount:

Text Input

Direct numerical entry allowing precise value input

Slider Input

Interactive slider with draggable control

Statistical Significance

I conducted a chi-square test to validate these findings, which confirmed the difference was statistically significant (p < 0.001).

Based on this clear data signal showing a 14.6% higher completion rate, I selected text inputs for all numerical values in the final interface design, balancing precision with usability.

Strategic Integration of AI Assistance

I made a deliberate architectural decision to integrate the AI chatbot after the calculation process rather than at the beginning of the user journey. This strategic placement was based on careful consideration of the user experience:

- Input Complexity: The calculator requires numerous structured inputs (deposit amount, credit card ownership, GIRO payments, etc.) which are more efficiently collected through a form interface.

- Conversation Efficiency: Having the chatbot collect these inputs would result in a lengthy sequential conversation, creating friction in the user experience.

- Contextual Value: The chatbot provides maximum value when helping users interpret results and understand the nuances of their calculated interest rates.

- Post-Calculation Support: After seeing their results, users typically have specific questions about optimization strategies, qualification criteria, and comparative analysis—precisely where AI assistance excels.

This approach balances structured data collection with conversational assistance, allowing each interface method to serve its optimal purpose in the user journey.

ANALYTICS

Measurement Framework

I established a comprehensive measurement framework to evaluate product success, focusing on these primary metrics:

- User Confidence Score: Measured through post-calculation survey

- Decision Time: Time from initial visit to completion of comparison

- Optimization Value: Percentage improvement through fund distribution optimization

- Satisfaction Rating: Post-usage satisfaction survey results

I implemented a robust analytics architecture to measure both usage and impact, with an event tracking framework aligned with the user journey, a feedback collection system, and performance monitoring for calculation response time.

SECURITY

Security Implementation

I implemented a comprehensive security strategy to protect user data and prevent common web vulnerabilities:

Input Sanitization

- DOMPurify Implementation: Added robust sanitization for all user inputs, configured to strip HTML tags and attributes to prevent XSS attacks

- Client-Side Sanitization: Sanitized user inputs in chat messages and calculator inputs before processing

- Server-Side Sanitization: Implemented middleware to sanitize all incoming requests including body, query parameters, and URL parameters

Rate Limiting

- API Rate Limiting: Implemented rate limiting on sensitive APIs (5 requests per minute per user) to prevent abuse

- User Experience: Added user-friendly error messages and visual styling for rate limit notifications

Authentication Security

- Supabase Authentication: Implemented secure email/password authentication with Google OAuth integration

- Auth Flow Protection: Created secure authentication redirects and properly managed sessions and tokens

- Production Configuration: Configured OAuth providers to only accept redirects to trusted domains

API & Data Security

- CORS Configuration: Properly configured CORS headers to restrict API access to trusted domains

- Secure Error Handling: Implemented error handling that doesn't leak implementation details

- Input Validation: Added checks for input types and formats before processing

- Protected Routes: Implemented access controls to protect sensitive functionality

This multi-layered security approach addresses key vulnerabilities including cross-site scripting (XSS), cross-site request forgery (CSRF), injection attacks, and authentication security, providing a robust security posture for the application.

IMPACT

Results & User Impact

Early results demonstrate significant impact on user financial decision-making:

- 76% of users report increased confidence in their banking decisions

- Average optimization value of 21% through the fund distribution algorithm

- Decision time reduced by 89% compared to manual comparison methods

- 4.7/5 average satisfaction rating from post-usage surveys

User feedback revealed several key insights: transparency drives trust, with users particularly valuing understanding exactly how interest is calculated; the fund distribution optimization feature receives the highest satisfaction ratings; and mobile usage exceeds expectations, with 68% of users accessing the tool via mobile devices and spending 24% more time exploring different scenarios.

APPROACH

Product Management

While developing this product independently, I applied enterprise product management methodologies throughout. This included structured stakeholder communication, agile project management with structured sprints, and comprehensive risk management.

I established a structured decision framework to guide product development with a Four-Factor Evaluation Model:

- User Value: Does this enhance the user's ability to make better decisions?

- Technical Feasibility: Can this be implemented reliably with available resources?

- Maintenance Impact: How will this affect ongoing maintenance requirements?

- Strategic Alignment: Does this advance the core product vision?

Based on usage data and feedback, I've evolved the product roadmap to focus on highest-impact enhancements, including enhanced scenario comparison functionality, personal financial goal integration, rate change alert system, and historical rate tracking visualization.

PRODUCT ROADMAP

Evolution & Future Plans

SmartSaver has evolved significantly from its initial concept, with each release adding valuable functionality based on user feedback and strategic priorities:

Initial Proof of Concept

Early Jan 2025

Developed basic calculation functionality using Streamlit to validate core concept.

- Basic interest calculator for single bank

- Simple qualification criteria inputs

- Basic results display

Initial React Implementation

Early Feb 2025

Rebuilt application using React for improved UX and performance.

- Multi-bank comparison

- Responsive design for mobile and desktop

- Improved visual presentation of results

First Production Release

Late Feb 2025

First full-featured release with core functionality complete.

- Comprehensive qualification criteria

- Detailed interest breakdown

- Error reporting system

- Basic analytics tracking

Current Release

Early Mar 2025

Enhanced with optimization features and AI assistance.

- Fund distribution optimization algorithm

- Scenario comparison functionality

- AI chatbot for user assistance

- Enhanced feedback collection system

Completed: Enhanced Security & Personalization

End Mar 2025

Added user authentication and comprehensive security measures.

- User authentication system with email and Google OAuth

- Saved scenarios and calculations

- Comprehensive security implementation including input sanitization with DOMPurify

- API rate limiting (5 requests/minute) to prevent abuse

- CORS configuration and protected routes

- Secure error handling and session management

Planned: Financial Intelligence Platform

Early Apr 2025

Expanding to a comprehensive financial decision platform.

- Personalized bank and product recommendations

- Integration with financial planning tools

- Advanced financial goal setting and tracking

- Expanded product coverage (loans, fixed deposits, etc.)

The roadmap is continuously refined based on user feedback, market trends, and strategic priorities, ensuring SmartSaver remains focused on delivering maximum value to users.

Share this post